Hourly salary calculator with overtime

Start with pay type and select hourly or salary from the dropdown menu. If youre paid an hourly wage of 18 per hour your annual salary will equate to 37440 your monthly salary will be 3120 and your weekly pay will be 720.

Hourly To Salary What Is My Annual Income

Pay for Hourly Employees.

. Use this calculator to easily convert a salary to an hourly rate and the corresponding daily wage monthly or weekly salaryUse it to estimate what hourly rate you need to get to a given salary yearly monthly weekly etc in other words calculate how much is X a year as a per hour wage. The salary calculator will also give you information on your weekly income and monthly totals. Monthly Salary Annual Salary 12.

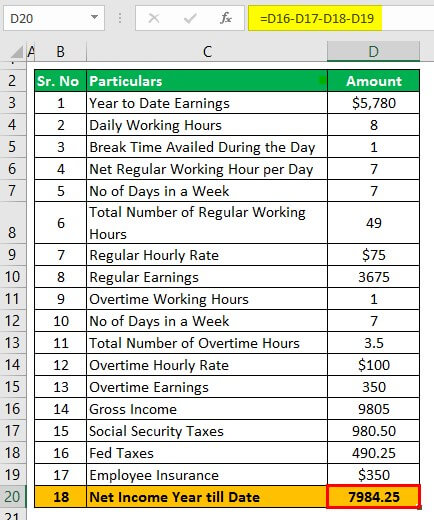

See where that hard-earned money goes - with UK income tax National Insurance student loan and pension deductions. The Hourly Wage Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay. Hourly wage 2500 Daily wage 20000 Scenario 1.

Biweekly Salary Annual Salary 26. The total worked time result and salary equivalent is found at the bottom of the timesheet calculator. Hourly employees are compensated at a set hourly rate which is multiplied by the hours worked during any given pay period.

Particularly when comparing annual salary to hourly salary or trying to determine commission and benefits. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. To keep the calculations simple overtime rates are based on a normal week of 375 hours.

For example if a worker has an hourly rate of 1050 and works 40 hours in a given week then their wages for that period would be 40 x 1050 or 420. Most companies offer 50 or 100 the regular salary rate for the overtime. For instance for Hourly Rate 2600 the Premium Rate at Time and One-Half 2600 X 15 3900.

Base salaries are usually paid to professional or exempt employeesworkers who meet the criteria for exemption from federal overtime laws under the Fair Labor Standards Act FLSA. Working on Christmas Day. Enter the number of hours and the rate at which you will get paid.

Use our United States Salary Tax calculator to determine how much tax will be paid on your annual Salary. Overtime Calculator Usage Instructions. There are two options in case you have two different overtime rates.

You can factor in paid vacation time and holidays to figure out the total number of working days in a year. Therefore overtime pay is not included in these calculations. Companies can back a salary into an hourly wage.

Hourly non-exempt employees must be paid time and a half for hours worked beyond 40 hours in a workweekIssuing comp time in place of overtime pay is not allowed for non-exempt employees. 2022 Salary Paycheck Calculator Usage Instructions. Weekly salary 60000.

Claims for compensation due to the late payment of wages. Hourly Rate Bi-Weekly Gross HoursYear Calculating Premium Rates. The salary calculator will also give you information on your daily weekly and monthly earnings.

Semi-Monthly Salary Annual Salary 24. Weekly Salary Daily Salary Days per workweek. For premium rate Double Time multiply your hourly rate by 2.

You can enter regular overtime and an additional hourly rate if you work a second job. These figures are pre-tax and based on working 40 hours per week for 52 weeks of the year with no overtime. Generally these are professional administrative executive or computer-related employees and they must earn more than 684 per week.

Another option field is this Hourly Rate. An employee receives a hourly wage of 15 and he works 40 hours per week which will result in the following earnings. His income will be.

For example for 5 hours a month at time and a half enter 5 15. Annual Salary Hourly Wage Hours per workweek 52 weeks. The formula of calculating annual salary and hourly wage is as follow.

Use our salary conversion calculator. In our example it gives 14hour 15 21hour. Who Receives a Base Salary.

Employers are required provided certain conditions. If the employee worked more than 40 hours and thus accrued overtime record 40 here and save the rest for additional pay. New York employers including many large retailers that pay their hourly employees on a bi-weekly or semi-monthly basis may be violating the New York Labor Law that requires manual workers be paid weekly within seven calendar days of the end of the week in which their wages were earned.

Quarterly Salary Annual Salary 4. If the employee is hourly input their hourly wage under pay rate and fill in the number of hours they worked that pay period. Easily convert hourly wage or pay rate to salary.

Employers must provide an employee with 24 hours written notice before a wage change. There are various hourly rates depending on the workers or individuals of the company. Hourly rates weekly pay and bonuses are also catered for.

For instance if a grocery store hires cashiers for an hourly rate of 1500 per hour on a full-time schedule of 40 hours a week you can calculate the annual pre-tax salary by multiplying the hourly rate by 40. The latest budget information from April 2022 is used to show you exactly what you need to know. An employees earnings may be determined on a piece-rate salary commission or some other basis but in all cases the overtime pay that is due must be computed on the basis of the regular rate.

And how much you are paid. This calculator assumes a work week consists of 40 hours and a work day consists of 8 hours. If you do any overtime enter the number of hours you do each month and the rate you get paid at - for example if.

Remember that a full salary with benefits can include health insurance and retirement benefits that add more value to your total annual salary compared to similar hourly rates. The regular rate is the average hourly rate calculated by dividing the total pay for employment except the statutory exclusions in any workweek by. Your overtime multiplier overtime hours worked and tax rate to figure out what your overtime hourly rate is and what your paycheck will be after income taxes are deducted.

Ad Choose Your Calculator Tools from the Premier Resource for Businesses. So if the example worker from above would have an additional 10 overtime hours their salary will be. Our hourly to salary calculator converts an hourly wage to annual salary or the other way around.

Salary to Hourly Calculator. 14hour 120 hours 21hour 10 overtime hours. Find out the benefit of that overtime.

DOL is increasing the standard salary level thats currently 455 per week to 684 per week. Overview of Federal Taxes When your employer calculates your take-home pay they will withhold money for federal and state income taxes and two federal programs. Enter your hourly wage and hours worked per week to see your monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan.

Gross Salary Wages Salaries. The overtime hours are calculated as 15 standard hourly rate but can vary depending on the circumstance eg. Overtime rate applies to any hours worked over 40 in a week Results.

Then multiply the product by the number of weeks in a year 52. A project manager is getting an hourly rate of 25 while working 8 hours per day and 5 days a week. Federal tax State tax medicare as well as social security tax allowances are all taken into account and are kept up to date with 202223 rates.

You may also want to factor in overtime pay and the effects of any. Visit to see yearly monthly weekly and daily pay tables and graphs. When you enable overtime the.

Determine the annual cost of raising an hourly rate or how hourly workers overhead business expenses on an annual basis. This calculator uses the 2019 withholding schedules rules and. For premium rate Time and One-Half multiply your hourly rate by 15.

Overtime Pay Calculators

Calculating Income Hourly Wage Youtube

Overtime Calculator

Overtime Pay Calculators

Overtime Pay Calculators

Overtime Calculator Workest

Hourly Paycheck Calculator Step By Step With Examples

How To Calculate Overtime Pay For Hourly And Salaried Employees Article

Hourly To Salary Calculator

Salary To Hourly Salary Converter Salary Hour Calculators

Overtime Calculator To Calculate Time And A Half Rate And More

3 Ways To Calculate Your Hourly Rate Wikihow

Tom S Tutorials For Excel Calculating Salary Overtime Tom Urtis

Hourly To Salary Calculator Convert Your Wages Indeed Com

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

4 Ways To Calculate Annual Salary Wikihow

Hourly Rate Calculator